Finance Fundamentals

Master the essentials of financial markets, investment strategies, passive income building, and economic principles

Understanding Market Cycles

Learn to identify and navigate the four distinct phases of market cycles - accumulation, markup, distribution, and markdown - and understand how investor emotions drive each stage from depression to euphoria and back.

- Four Stages: Accumulation to Markdown

- Investor Psychology & Emotions

- Technical Indicators & Moving Averages

- Smart Money vs Retail Behavior

- Defensive vs Cyclical Sector Rotation

Reading Financial Statements

Master the five core financial statements - balance sheet, income statement, cash flow statement, statement of changes in equity, and comprehensive income - to evaluate company health, profitability, and long-term viability.

- Balance Sheet: Assets = Liabilities + Equity

- Income Statement: Revenue, Expenses & Net Profit

- Cash Flow: Operating, Investing, Financing

- Changes in Equity & Comprehensive Income

- Financial Ratios: Liquidity, Profitability, Leverage

Value Investing Principles

Master the timeless principles of value investing used by Warren Buffett and Benjamin Graham to find undervalued opportunities in the market.

- Intrinsic Value Calculation

- Margin of Safety Concept

- Economic Moats Analysis

Growth Investing Strategies

Learn to identify and invest in high-growth companies with the potential to deliver exceptional long-term returns.

- Identifying Growth Companies

- Valuation Approaches

- Risk Management

Dividend Investing Strategy

Build reliable income streams and long-term wealth through strategic dividend investing and reinvestment.

- Dividend Metrics & Analysis

- Building Dividend Portfolios

- Reinvestment Strategies

Passive Income Strategies

Master the logic, principles, and long-term approach to building passive income streams that create financial freedom.

- Philosophy of Passive Income

- Multiple Income Streams

- Long-Term Wealth Building

- Freedom & Financial Independence

The Emotional Trap: Fear and Greed in Investing

Understanding how fear and greed sabotage investment decisions. Learn from DALBAR studies, Peter Lynch, and Benjamin Graham to overcome emotional investing traps.

- Fear and Greed Psychology

- Behavioral Finance Data

- Peter Lynch's Framework

- Benjamin Graham's Margin of Safety

- Actionable Discipline Strategies

Technology Investing

Navigate the fast-paced world of technology investments and emerging innovations

AI & Machine Learning Investments

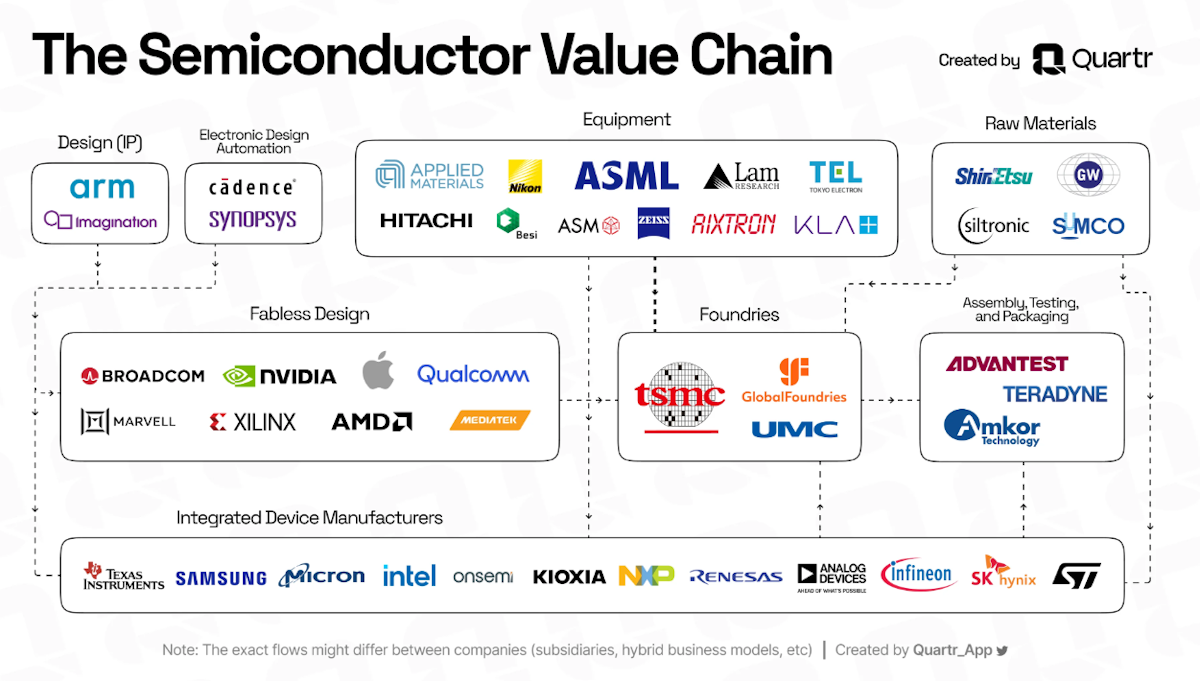

Navigate the AI revolution by understanding the full value chain - from semiconductor equipment makers and chip foundries to cloud infrastructure providers and AI software builders. Learn hardware enablers, platform giants, and pure-play opportunities across the ecosystem.

- Chip Infrastructure: NVIDIA, TSMC, ASML

- Platform Giants: Microsoft, Google, Amazon

- Equipment & Materials Suppliers

- Pure-Play AI Companies & ETFs

- Supply Chain: Fab, Design, Testing, Packaging

Semiconductor Industry Deep Dive

Explore the semiconductor supply chain, key players, and how to invest in the backbone of modern technology.

- Chip Design vs Manufacturing

- Supply Chain Dynamics

- Geopolitical Considerations

Cryptocurrencies

Learn about digital assets, blockchain technology, and crypto market dynamics

Bitcoin Fundamentals

Start your crypto journey with a comprehensive introduction to Bitcoin, its technology, use cases, and investment considerations.

- What is Bitcoin?

- Blockchain Technology Basics

- Bitcoin as Digital Gold

- Security & Storage

Altcoins & DeFi Ecosystem

Explore alternative cryptocurrencies, decentralized finance protocols, and the expanding crypto ecosystem beyond Bitcoin.

- Ethereum & Smart Contracts

- DeFi Protocols Overview

- Evaluating Crypto Projects

Macroeconomics & Markets

Understand how global economic forces shape financial markets and investment opportunities

Trade Wars & Market Impact

Analyze how international trade conflicts affect global markets, supply chains, and investment strategies.

- Understanding Tariffs & Trade Policy

- Supply Chain Disruptions

- Currency Market Effects

Energy Markets & Geopolitics

Learn how energy resources drive geopolitical decisions and create investment opportunities in oil, gas, and renewable energy.

- Oil Market Dynamics

- OPEC & Global Supply

- Energy Transition Investing